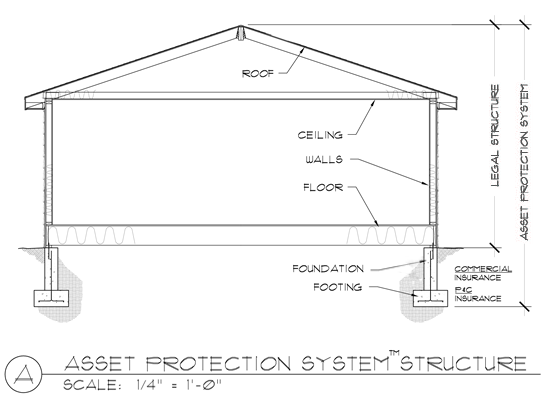

An important component of tax, asset protection, business, and estate planning is insurance coverage. This planning is built on the footings and foundation of insurance coverages.

Many people do not understand what their various insurance policies do and do not do. We do not take at face value assumptions that you are adequately covered with appropriate policies in each aspect of your insurance planning. Occasionally policies are placed which will not achieve your desired outcome. Further, in today’s fast paced global environment, coverage quickly becomes insufficient or outdated.

It is for this reasons that it is essential to have an Insurance Risk Assessment to identify gaps and overlaps in your insurance coverage. This analysis includes a) evaluation of coverage held; b) scope of coverage; c) exclusions; d) coverage amounts; and e) coverage requirements based upon risks and objectives. Only after such an in-depth assessment should policies be supplemented, placed, or replaced.